Bad Credit Financing - Questions

Table of ContentsThe 10-Minute Rule for Bad Credit FinancingThe Ultimate Guide To Bad Credit FinancingBad Credit Financing Fundamentals ExplainedThe smart Trick of Bad Credit Financing That Nobody is Talking AboutThe Best Guide To Bad Credit FinancingThe smart Trick of Bad Credit Financing That Nobody is Talking AboutHow Bad Credit Financing can Save You Time, Stress, and Money.

Debtors with poor debt may receive lower rates of interest considering that they're putting up collateral. If you fail on a protected funding, your lender might legally seize your collateral to recuperate the money. And also if your loan provider does not redeem the cost of the financing by redeeming your possessions, you might be in charge of the difference.This method can make it less complicated for customers with bad credit to be eligible for a loan, as it reduces the primary customer's risk. If you're unable to pay on this sort of loan, not just can your loan provider attempt to gather from you, they can additionally attempt to collect on the funding from your co-borrower.

Cash advance car loans are thought about an extra uncertain kind of lending, with astoundingly high charges as well as rate of interest. These financings are generally less than $500 as well as are expected to be paid back within 2 to four weeks. Lots of people that secure payday advance frequently have to get additional car loans to settle the original payday advance loan, capturing them in a cycle of financial obligation - bad credit financing.

5 Easy Facts About Bad Credit Financing Described

Customers who have excellent histories with their financial institution. If you require a short-term repair, you can utilize a currently favorable relationship for monetary support. This option might not be used at all banks. If you have negative credit score, you may be able to cash in on the equity you've constructed right into your home making use of a home equity car loan.

Like personal finances, with a house equity finance, you'll be given the cash in a lump sum. Those that require large amounts of cash as well as have equity in their residence Permits debtors to secure up to 80% of their home's worth. Since you're utilizing your home as collateral, back-pedaling your house equity lending may cause losing your house.

Unlike home equity lendings, HELOCs usually have variable rate of interest prices. Debtors who aren't sure just how much money they require as well as desire to be able to borrow from their residence's equity over an amount of time Customers can borrow and also pay back as needed, and reuse the line of credit history. Given that interest rates vary, debtors might experience very month-to-month payments.

Some Known Facts About Bad Credit Financing.

While lots of lenders don't permit debtors to utilize an individual car loan toward education financing, lenders like Startup do permit it. Those who are seeking funding for educational purposes Some trainee funding lenders will cover to the whole price of your tuition. Some loan providers have rigorous or vague forbearance and deferment programs or none in all in case you're incapable to settle the finance down the road.

Make up all personal earnings, consisting of income, part-time pay, retirement, investments as well as rental homes. You do not require to include alimony, kid assistance, or different upkeep earnings unless you desire it to have it considered as a basis for paying back a lending. Boost non-taxable earnings or benefits consisted of by 25%.

The deals for economic products you see on our platform originated from firms that pay us. The money we make helps us provide you accessibility to cost-free credit rating and reports as well as assists us develop our various other wonderful tools and also academic products. Payment might factor into exactly how and also where items appear on our platform (and in what order).

An Unbiased View of Bad Credit Financing

That's why we offer features like your Approval Odds and cost savings estimates. Of course, the deals on our platform do not represent all financial products around, however our goal is to reveal you as numerous fantastic options as we can. That does not indicate you ought to surrender. If you require the money for a real emergency expense or various other use, you can discover lenders that supply personal lendings for negative credit history.

Also bear in mind that these fundings are not always available in all states. Auto-secured lendings from One, Main Financial commonly have lower rate of interest prices than the firm's unsecured fundings. Yet they come with costs, including origination, late as well as not important link enough funds fees that may enhance the amount you have to pay off.

Not known Details About Bad Credit Financing

Possible offers the option to borrow up to $500 "instantaneously" and also repay your loan in 4 installations. The lending institution claims it usually disburses funds within simply mins yet that it might occupy to 5 days. Possible isn't available in all states, so check if it's offered where you live before you use.

The application does not bill passion when you select the pay-in-four option, as well as there are no charges if you pay in a timely manner. If your settlement is late, you may be charged a late fee of up to 25% of the order value. The amount you can spend with Afterpay varies based on several aspects, consisting of for how long you have actually been an Afterpay customer, just how typically you utilize the application, your application repayment background as well as even more.

8 Easy Facts About Bad Credit Financing Described

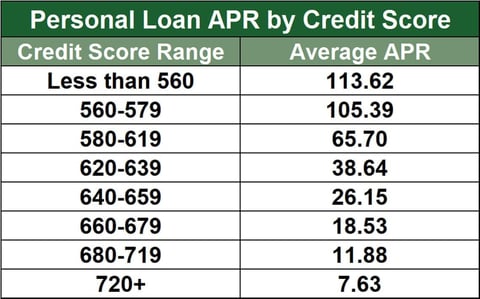

Whether you wish to settle high-interest financial debt, finance a home improvement or care for an emergency situation cost, an individual loan might assist. Here are some points to understand if you're considering looking for an individual finance with poor credit scores. If you have bad credit, an individual funding may cost you extra since lenders might see you as a greater debt danger.

A lower APR implies the funding will normally cost you much less. An individual finance for a person with poor credit will likely have a greater APR.

The Single Strategy To Use For Bad Credit Financing

The majority of personal loans require you to make set month-to-month payments for a set period of time.

The Better Business Bureau knows concerning lots of loan providers, and also you can inspect the consumer issue database preserved by the Customer Financial Security Bureau to discover if people have filed complaints against a lender you're taking into consideration. While getting approved for a personal funding can be you could try these out tough and also explanation costly for somebody with poor credit rating, loaning may make sense in specific situations.